Everyone has a different relationship with money. But what does the data say? In this article, let’s take a look at financial wellbeing statistics to understand how people really feel about their cash and how it can affect their wellbeing.

Financial wellbeing doesn’t necessarily mean having a lot of money, or a nice car or a big house. It means feeling content, comfortable and secure with your financial situation, and feeling able to live the life you want to live.

When you do not feel this way about your money, you are at risk of poor financial wellbeing, which can lead to anxiety, stress and depression.

With living costs soaring, financial wellbeing will be top of mind for many people right now. To help you understand these effects, we’ve compiled the most recent financial wellbeing statistics in the UK.

The knock-on effects of poor financial wellbeing also pose serious challenges for organisations, as poor financial wellbeing has been linked to both reduced employee health and impaired employee performance. Therefore, we’re also going to look at employee financial wellbeing statistics.

Note: Looking for statistics on more mental health challenges? Read this article for a comprehensive look at mental health statistics.

Financial wellbeing statistics

Firstly, let’s look at financial wellbeing statistics that comprise the entire UK population.

The research below really highlights the scale of the issue. In the UK alone:

- Over 1.5 million people are experiencing both problem debt and mental health problems (Money and Mental Health)

- As many as 24 million adults don’t feel confident managing their money (Money & Pensions Service)

- Only a third of the people in financial debt receive help (Financial Capability Survey)

Research also reveals the strong link between financial wellbeing and mental health. The statistics show that:

- Half of people in problem debt have a mental health problem (Money and Mental Health)

- Almost 40% of people with a mental health problem say their financial situation worsens it (Money and Mental Health)

Financial wellbeing affects everyone, regardless of whether they have a stable income or not. With that in mind, read the next section to discover the financial wellbeing of employees in the UK.

Employee financial wellbeing statistics

The experts at Champion Health revealed the impact of financial wellbeing on UK employees in two reports: the Workplace Health Report and Cost of Living Crisis: Financial Stress and Employee Wellbeing.

Across these two publications, we set out to discover the health challenges faced by the UK’s workforce, from financial wellbeing to MSK health, to sleep quality and beyond.

As part of this, we analysed the anonymous data of over 4,000 employees, across a range of demographics and sectors.

The result was a comprehensive range of employee wellbeing statistics, which included many findings regarding financial wellbeing.

Our financial wellbeing statistics discovered that:

- Financial pressure is the top cause of stress outside of work (37%)

- Employees aged 25-34 are the most affected age group (45% cite finances as a cause of stress)

- Female employees are 33% more likely to experience financial stress than their male colleagues

- Those experiencing financial stress are twice as likely to experience suicidal thoughts

- 1 in 5 employees say financial stress impacts their productivity

Read on to explore these findings in more detail.

1. Financial pressure is a top cause of stress

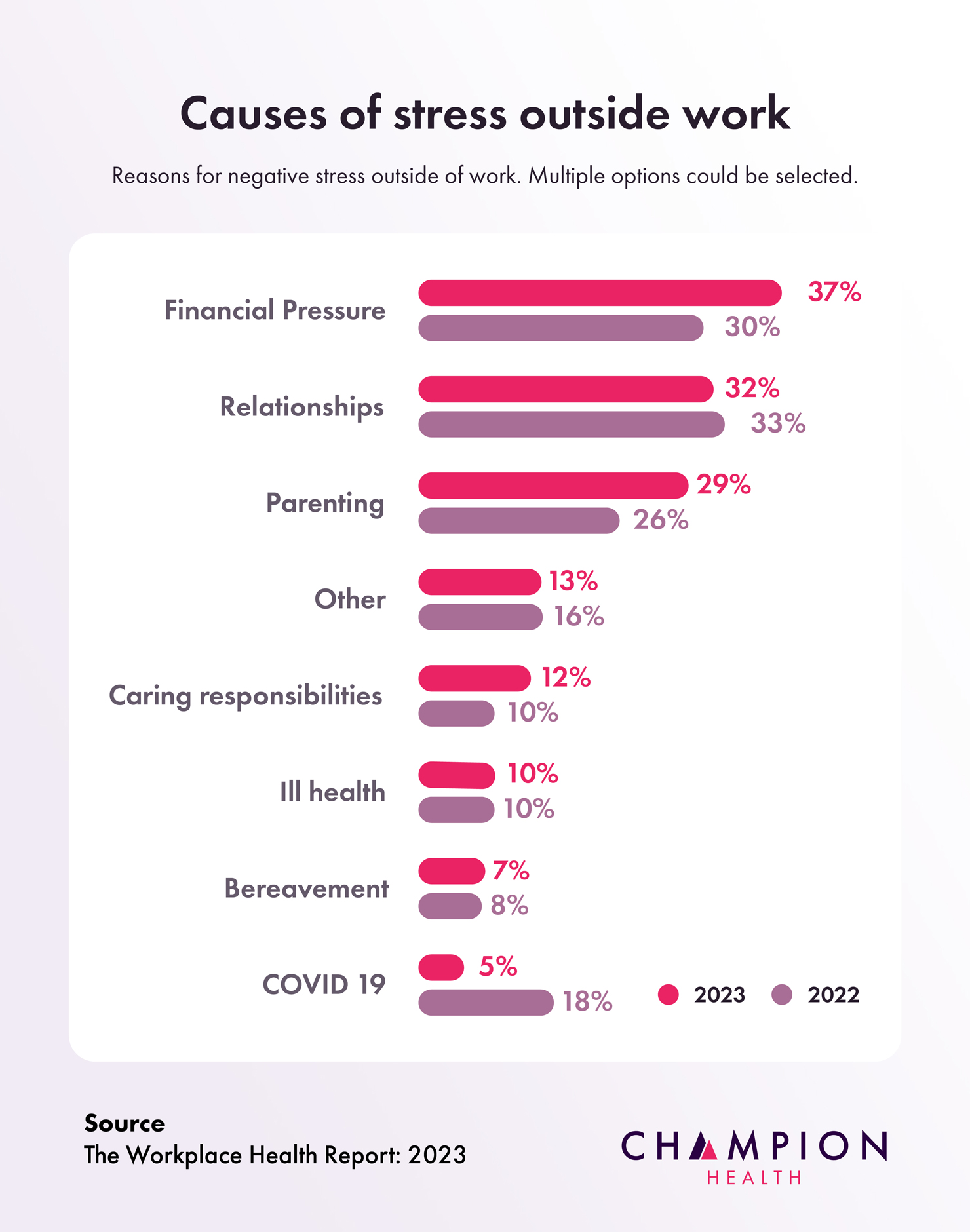

Champion’s data reveals that financial pressure is the most common cause of stress outside of work for employees, with 37% of all employees citing it.

This means finances have overtaken relationships as the leading cause of stress for employees, when compared with findings from The Workplace Health Report.

Financial pressure outranks relationships and parenting as causes of stress outside the workplace. Stress surrounding caring responsibilities affects 12% of employees and 5% cite COVID-19 as a stressor.

2. Younger employees are struggling with financial wellbeing

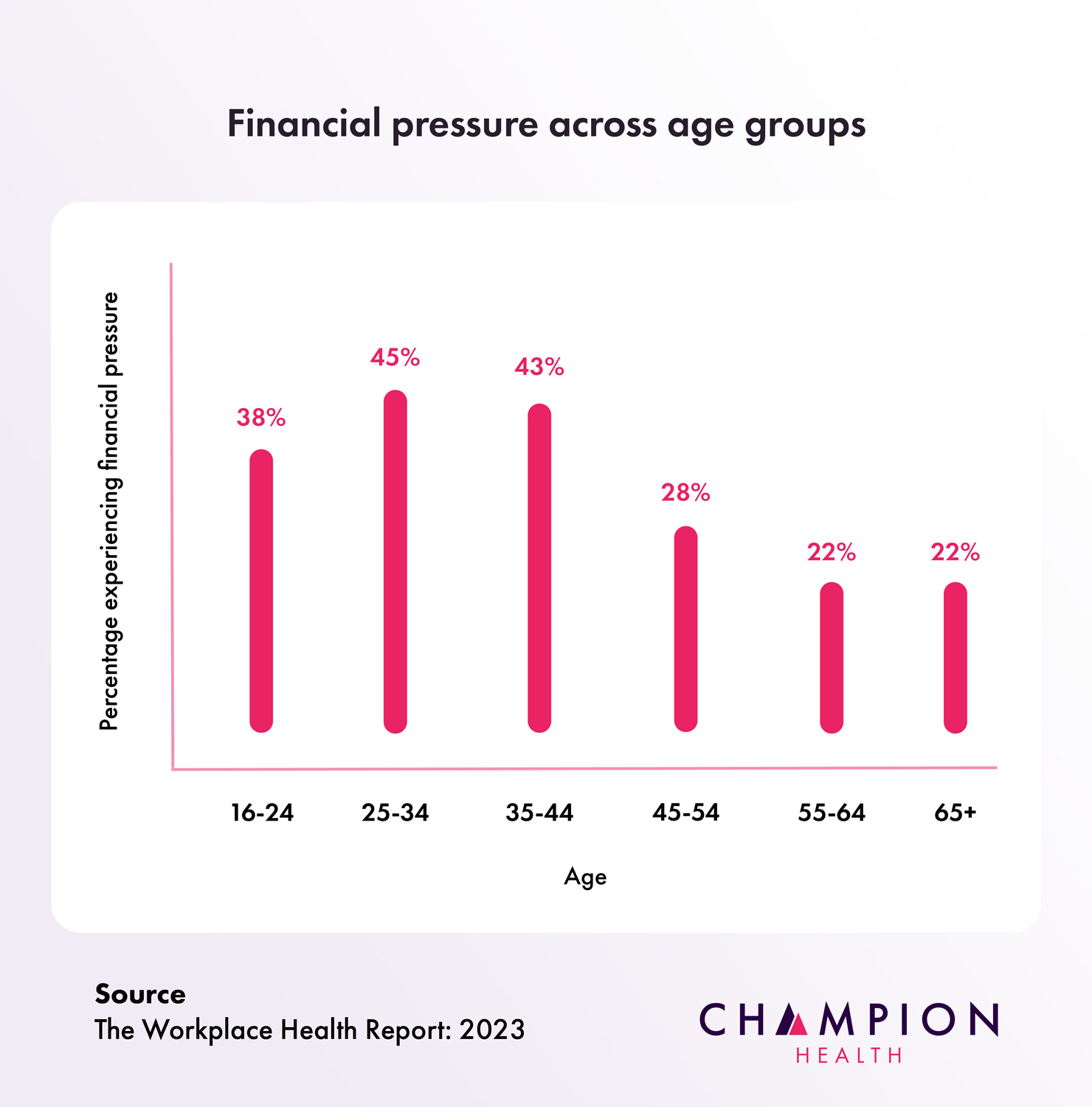

Champion Health’s financial wellbeing data suggests that younger employees are disproportionately affected by poor financial wellbeing. Of employees aged 25-34, 45% cite financial pressure as a cause of stress.

Employees aged between 35 and 44 are the next most affected group, with 43% experiencing financial stress. They were closely followed by employees aged 16-24, of whom 38% are experiencing financial stress.

As age increased, the impact of financial stress lessened, with only 28% of employees aged 45-54 citing financial pressure as a cause of stress, and only 22% of employees aged 55-64.

3. Female employees are 33% more likely to experience financial stress than their male colleagues

Money worries do not impact everyone equally. Champion’s data shows that female employees are 33% more likely to experience financial stress compared to their male counterparts.

There are likely numerous reasons for this finding, but it takes on added significance in the context of research from Aon, which suggests there is a significant financial wellbeing gap between male and female employees.

4. Those experiencing financial stress are twice as likely to experience suicidal thoughts

Champion’s data also reveals that employees experiencing financial stress are twice as likely to experience thoughts of suicide or self-harm. That’s a stark statistic, especially when employees are living through the cost of living crisis.

This data aligns with findings from the UK’s Money and Mental Health Policy Institute that those who have recently experienced a major financial crisis are almost eight times as likely to experience suicidal thoughts as those who have not.

5. 1 in 5 employees say financial stress impacts their productivity

Financial stress is also impacting our ability to work at our best, with 1 in 5 employees reporting that financial stress affects their productivity. This result highlights how poor employee financial wellbeing impacts a business’s bottom line.

Research by CIPD also found that poor financial wellbeing contributes to increased rates of absenteeism and presenteeism.

Financial pressure can lead to absenteeism in various ways. These can include anything from short-term absences to manage finances, to long-term absences to recover from more serious health issues such as emotional exhaustion and stress-related illness.

“Employees who are tired, or in a bad place mentally, will not perform to their best. On the flip side, those employees who are thriving personally will also thrive professionally,” adds Jack Green, Head of Performance at Champion Health.

What these financial wellbeing statistics mean for organisations

The research paints a clear picture: financial wellbeing is on the decline and millions of people are being affected.

These effects have permeated into our workplaces, with 37% of employees citing financial wellbeing as a source of stress. It’s therefore imperative that organisations ease this pressure.

There are many ways that leaders can do this, including:

- Normalising the conversation around financial wellbeing

- Promoting internal financial wellbeing offerings

- Signposting towards external financial wellbeing support services

Learn more about supporting your employees with their financial wellbeing in this article discussing financial wellbeing at work.