Financial wellbeing is a key pillar of employee wellbeing that must be integrated into your workplace health strategy. For leaders and people managers that want to make a difference, use this guide to support your employees’ financial wellbeing at work.

We revealed the impact of financial wellbeing and financial stress on UK employees in the Workplace Health Report and Cost of Living: Financial Stress and Employee Wellbeing.

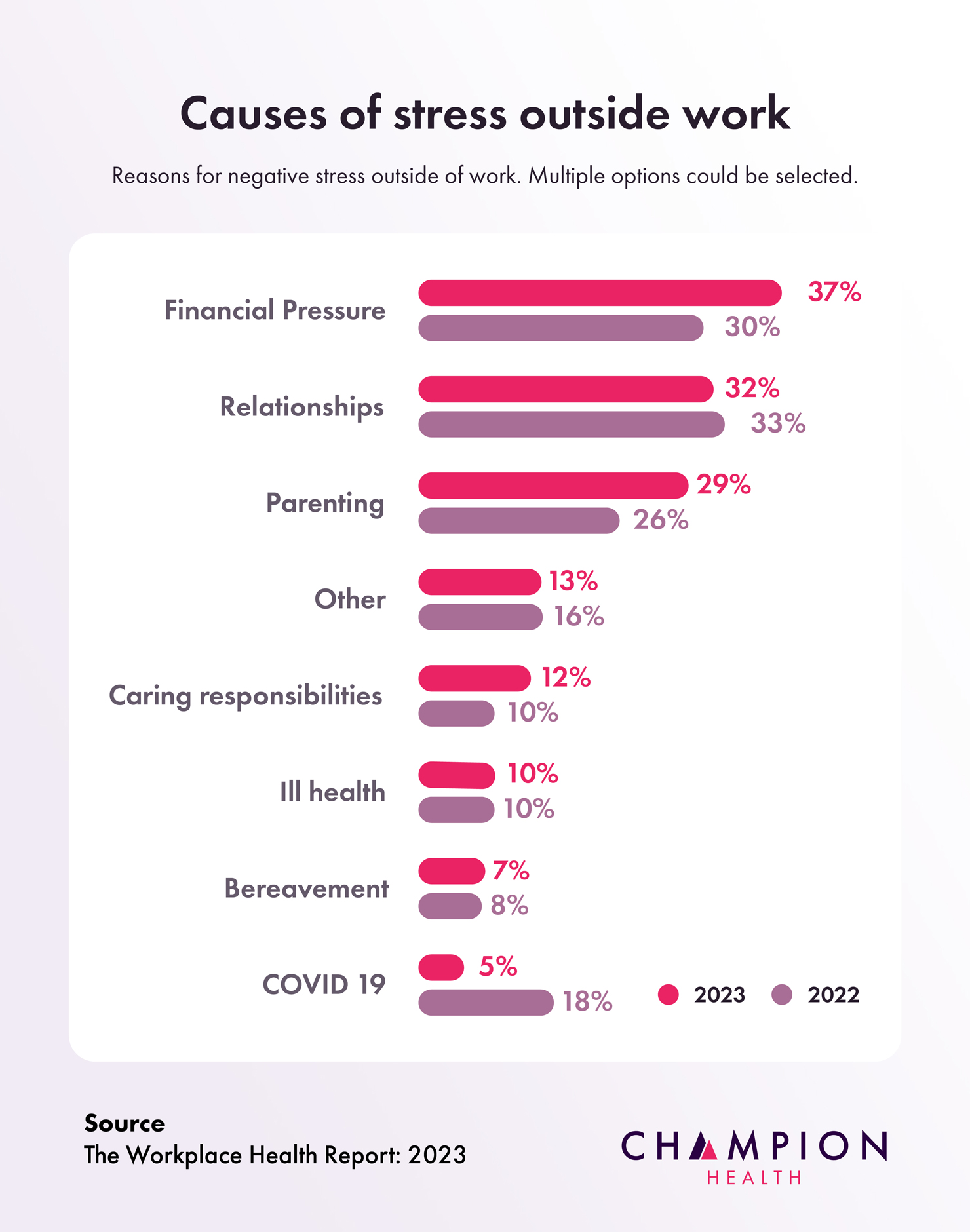

These reports contained financial health statistics revealing that poor financial wellbeing is widespread among the UK workforce, with 37% of employees citing financial pressure as a source of stress outside work.

Employees also reported that financial pressure was their most common cause of stress outside work, followed by relationships, parenting and caring.

This data considered, it’s time for every organisation to take financial wellbeing at work seriously. In this article, you’ll discover:

- What is financial wellbeing?

- The moral and business case for financial wellbeing support

- How to support employee financial wellbeing at work

What is financial wellbeing?

Financial wellbeing (also known as financial health) may look different for every employee, but in general, it means feeling content, comfortable and secure with your financial situation, and able to live the life you want to live.

Watch: How financial stress is linked to wellbeing

It means feeling in control of your spending, and confident about your finances. It means feeling assured that you can pay the bills today and deal with the unexpected tomorrow, while staying on track for a healthy financial future.

When these feelings are not present, employees are at risk of poor financial wellbeing, which will affect their physical wellbeing, their mental wellbeing, and their performance in work.

Financial wellbeing at work: the moral and business case

Poor financial wellbeing is not only an issue for employees – it is an issue for employers as well. Research has consistently linked financial health to both employee wellbeing and performance, and we’re going to dive into that below.

From a wellbeing angle, Champion Health’s Workplace Health Report shows how financial wellbeing impacts multiple areas of employee health.

The data revealed that 1 in 5 employees say money worries are impacting their ability to peform at work.

To compound the problem, these issues often affect an employee’s capacity to work, which can lead to anxieties around job security. This in turn can further diminish financial wellbeing.

There’s also a business case for implementing financial wellbeing support: poor financial wellbeing contributes to increased rates of absenteeism and presenteeism, both of which have a significant impact on work performance.

To reduce both the personal and professional risks associated with poor financial wellbeing, the onus is on organisations to integrate financial wellbeing policies into their wider wellbeing strategy.

As Laura Dallas, Head of Product at Champion Health, says: “The research shows that money worries are having an impact on both the physical and mental health of employees, which inevitably has an impact on their work performance.

“Therefore, in these uncertain times, providing financial wellbeing support is vital from both a moral and a business angle.”

Ways to support the financial wellbeing of your employees

Providing financial wellbeing support does not simply mean paying your people more. There are other actions you can take to help your employees.

With that in mind, here are five ways to support the financial wellbeing of your employees.

- Normalise the conversation around financial wellbeing

- Promote internal support systems

- Signpost to external support services

- Discover the specific challenges facing your employees

- Focus on the present as well as the future

Read on for a more detailed look at the steps you can take to support your people with their financial wellbeing.

1. Normalise the conversation around financial wellbeing

Talking about money is never easy for employees, especially if they are concerned about their financial situation. Research by Salary Finance found that 81% of employees don’t comfortable talking about money.

This reluctance to discuss finances may be preventing your employees from seeking the support they need.

It’s therefore crucial that organisations break the stigma surrounding financial wellbeing. Salary Finance and CIPD recommend that employers normalise this conversation by:

- Encouraging line managers to communicate an open and honest dialogue around the financial challenges facing both themselves and their teams

- Bringing up financial wellbeing during staff appraisals and 1:1s

- Encouraging senior leaders to share their stories of financial wellbeing

2. Promote internal support services

Nearly half of all employers have a financial wellbeing policy in place. If you are one of these organisations, ensure your employees understand how to make the most of this support.

Promote your internal support by:

- Running internal campaigns around specific awareness weeks, such as Talk Money Week, where you promote the financial wellbeing services you offer

- Integrating your financial support services into regular communication cycles

3. Signpost to external support services

Even if your organisation doesn’t have a financial wellbeing policy in place, you can still support your employees. There are many external support services to signpost employees to if they are in financial distress.

For instance, the government’s Money and Pension’s Services offers free, confidential and independent money and debt advice.

4. Discover the specific challenges facing your employees

Poor financial wellbeing has many different causes, which often vary between employees.

For some employees, research by Deloitte indicated that poor financial wellbeing is being caused by worries about the future.

Research by Salary Finance showed that looking after loved ones financially and having to borrow money to fund this support are contributing significantly to financial stress.

As the research shows, each employee will require different forms of support to help improve their financial wellbeing.

By understanding each employee’s unique situation, you are in a much better position from which to support them, so take the time to discover their specific financial challenges.

You may think that this is “overstepping a boundary”, but employees often want their leaders to take an active interest in their personal lives, especially if personal challenges are affecting their professional performance.

5. Focus on the present as well as the future

Traditionally, employers focus on long-term financial support, such as share schemes and pensions.

While these are important, employees who are experiencing financial pressure often require support that will help them right now.

To appropriately support these people, ensure that your financial wellbeing offering addresses the issues that your employees are facing in the present. These offerings could include:

- On-demand pay

- Support paying off debts

- Easy access savings

Financial wellbeing at work: it’s a must-have

Financial wellbeing support is no longer a nice-to-have for organisations – it’s a must-have and should form an integral part of every wellbeing strategy.

With poor financial health affecting almost one-in-three employees, it’s crucial that employees feel empowered and supported.

By providing this support, you will not only improve your employees’ performance in work but also make a real difference to their quality of life.